Is Your Loved One Being Financially Exploited?

Has your loved one been incapacitated and has someone take over power of attorney? Has that person (the agent) taken actions or made decisions that you believe are not in your loved one’s best interest? Agents granted power of attorney have a legal obligation to act in the best interests of the incapacitated person (the principal). The actions and behavior of the agent in a power of attorney situation are governed by the Texas Estates Code.

Elder financial exploitation is on the rise in Texas, so if an agent has been named for you or for someone you love, you must know the signs of abuse of that power and, if necessary, take appropriate action.

What Does it Mean to Have Fiduciary Responsibility?

When a person accepts a role as the agent or attorney-in-fact for an incapacitated person, they have a fiduciary duty to the incapacitated person (the principal). Fiduciary responsibility falls into two categories: the duty of loyalty and the duty of care. The duty of loyalty means that the agent must, at all times, act in the interest of the principal without any self-dealing, conflict of interest, or appearance of conflict of interest when managing the principal’s financial and legal affairs. The duty of care means that the agent must ensure that the principal’s basic needs are met.

If you suspect that an agent is failing at their fiduciary duties to someone you know or love, there are steps that you can take to address the situation.

What Can I Do if I Suspect an Agent is Abusing their Power of Attorney?

Whether you are a concerned party or the principal, there are steps that you can take to revoke power of attorney granted to a person who is abusing that power. The most straightforward way to do so involves a principal who is mentally and physically capable of taking steps to revoke the power of attorney on their own behalf. In this case, an experienced estate planning attorney from Hatchett Law Firm can assist you in filing the proper paperwork to revoke the previous power of attorney and help you draft a new power of attorney document, naming a more trustworthy person as agent.

If the principal is not mentally or physically capable of taking these steps themselves, however, the process is more complex. If you suspect that an incapacitated loved one has an agent who is defrauding them or not meeting the duty of loyalty or the duty of care inherent in the agent’s position, you will need to take legal steps to have a guardian put in place. Once a guardian is in place for the principal, now called the ward, the guardian may take steps to revoke a previous power of attorney on the ward’s behalf.

Here at Hatchett Law Firm, we bring all of our skill and knowledge as experienced guardianship and estate planning attorneys to bear in ensuring that you or your loved one are taken care of properly by a trustworthy agent or guardian. You don’t have to navigate the process alone. We are here to help.

What Are the Signs That Someone is Being Financially Exploited by an Agent?

Financial exploitation by an agent is the unauthorized or inappropriate use of the principal’s financial resources for the agent’s personal gain. Financial exploitation may include stealing cash, forging a signature, or coercing the principal into signing checks or other financial documents.

The warning signs of financial exploitation by an agent include but are not limited to:

- Unusual or unexplained financial activity: Unexpected, substantial transfers or withdrawals may indicate financial exploitation. Regularly review your or your loved one’s bank statements and finances for any suspicious activity.

- Changes to estate planning or insurance documents: Unexpected and unnecessary revisions to a will, trust, insurance policy, or power of attorney may indicate financial exploitation.

- Isolation from friends and family: An agent who is financially exploiting the principal may try to isolate that person from his or her friends and loved ones in order to make the exploitation easier (and more difficult to detect).

- Neglect of basic needs: If a person’s healthcare, housing, or nutritional needs are not being adequately met, it’s possible that their resources are being diverted or stolen.

- Unfamiliar new people: Be suspicious if an agent introduces unfamiliar new people into the principal’s life, especially if the new people seem to have an interest in their financial affairs.

Take These Steps if You Suspect Financial Exploitation by an Agent

In the State of Texas, if you suspect that you or a loved one are being financially exploited by an agent with power of attorney take these steps at once:

- If the principal is a loved one, speak privately with them, voice your concerns, and ask about their financial situation.

- Compile any documents that support your misgivings. These may include bank statements, other financial documents, or other evidence of unmet needs.

- Schedule a consultation with a Texas fiduciary litigation attorney, explain your concerns, and share your documentation. Your attorney will advise you regarding how to proceed and will determine if you should involve Adult Protective Services or the local police.

Agents in Texas who are accused of the financial exploitation of a principal may face criminal charges and may also be subject to civil lawsuits.

How Can You Locate a Reliable Attorney to Help?

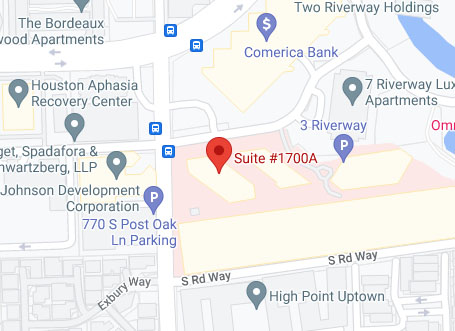

If you want the court to name a guardian for an elderly or incapacitated loved one, if you need legal advice about a breach of fiduciary duties, or if you suspect that an agent with power of attorney is financially exploiting you or someone you love, arrange at once to speak with an attorney at the Hatchett Law Firm.

Your first consultation with an estate planning lawyer at the Hatchett Law Firm is offered without cost or obligation. We work with and for families throughout the State of Texas.

Contact the Hatchett Law Firm now for the advice and guidance you need by calling 281-771-0560 and scheduling a free case evaluation.