The thing that separates letters testamentary and letters of administration is whether or not a valid will is present. Letters testamentary are granted to an individual if they have been named executor in the decedent’s will. Letters of administration, however, are given to an administrator appointed by the probate court if the decedent died intestate, or without a valid will.

Both documents grant the same powers to the holder. However, with letters of administration, the court has the ability to rule on who the official heirs to the estate are. Someone holding letters testamentary can instead distribute assets based on the decedent’s will.

What Is Probate?

Probate is the process where a court legally recognizes a person’s death and then oversees the payment of any debts they have left behind, as well as distributing their assets. Generally, in Texas, the rule is that the executor must file for probate within four years of the death of the person who drafted the will, known as the testator. If the will is not filed within that time period, then the laws of intestacy (which apply when there is no valid will) govern the decedent’s asset distribution.

Probate is usually a long and complex process, with even the most uncomplicated estates taking up to six months to complete. However, it is best to plan for the probate process to take a year or more, especially if the original will cannot be found or is being contested.

Who Are Executors and Administrators?

When it comes to the actual duties they are meant to perform, executors and administrators are the same. The distinction between the two comes in how they are appointed to their tasks. An executor is chosen directly by the decedent by being nominated within the will. On the other hand, administrators are appointed by the court if there is no will and, therefore, no executor.

While executors and administrators both have the legal authority to carry out their duties, executors have any additional powers that are granted in the will. They may, for example, sell property without going through the courts, as long as that is what they will asked of them. An administrator must always go through the courts.

What Are the Grounds for Removing an Executor?

When an executor fails to perform their duties, commits misconduct involving the estate, or otherwise shows themselves unfit for their role, the court can remove them. This can either be done either with or without notice.

An executor is removed without notice if they cannot be served with a notice. This can be due to their whereabouts being unknown, them eluding service, or them being a non-resident of Texas. If there are sufficient grounds to support a belief that the executor either has or intends to misapply or embezzle all or some of the property committed to their care, they may also be removed with no notice given.

Outside of the situations listed above, a probate court may remove an executor by providing them with a 30-day notice. An executor may be removed because they failed to make an accounting, failed to file the required documentation in a timely manner, became incapacitated or were sentenced to jail, were found guilty of gross misconduct or mismanagement, or were found to have a conflict of interest that would prevent them properly carrying out their duties.

How Do I Obtain the Proper Letters?

As letters of administration and letters of testamentary have different requirements, the process differs between the two. If there is no will in place, the next of kin will need to apply for letters of administration. You will need several documents, including the original death certificate, titles for any property owned, and certifications of valuations of assets. Once you have produced the proper documentation, and assuming there are no challenges from other relatives, you should be granted your letters within eight weeks.

As an executor is named in the will of the decedent, the first step to obtaining letters testamentary is having the courts approve the will and determine the qualifications of the executor named within. As with administration, you must gather the relevant documents. You must then file for and attend a probate hearing, where a judge will make an official ruling, and you will receive your letters.

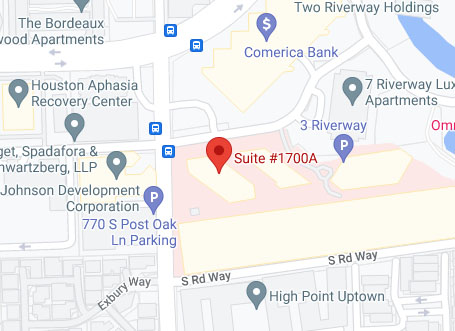

Both these processes can be very complex, and any missteps can cause setbacks in what is already a long timeline. One way to make the process as smooth and efficient as possible is to hire an experienced attorney who can guide you and keep you from making any costly mistakes. For the legal help and the answers you deserve, call 281-771-0560 now.