A transfer on death deed, or a TODD, is a way to title real estate so that it transfers upon your death to a beneficiary of your choosing. This is a method that avoids probate and makes the process of passing on real estate more simplified and streamlined. It is sometimes referred to as a beneficiary deed, as its purpose is to name the beneficiary who will receive your property after you die.

The most significant benefit that a TODD offers is a time and money-saving alternative to going through probate. This means that the beneficiary will get their inheritance much quicker, and they can avoid the stressful situation of going through probate when they are mourning the recent death of a loved one.

When Can I Use a Transfer on Death Deed?

It is important to note that not all states allow transfer on death deeds. Texas is a state that does allow them. However, the property must be within the state. That means if you live in Texas but have a property in Pennsylvania (a state in which TODDs are not allowed), that property is not eligible for a TODD.

Certain types of property are not eligible to be passed on to a beneficiary using a transfer on death deed. The transferable property includes land, homes or other buildings, and mineral rights. Personal property like jewelry, clothing, and furniture are not eligible.

How Is a Transfer on Death Deed Different From a Will?

Both TODDs and wills are methods to distribute property to heirs upon your death. Each one offers its own advantages and drawbacks, and they are not mutually exclusive, meaning a person may have both a will and a transfer on death deed.

A will must go through probate, and as such, a TODD is a faster and cheaper alternative. A will, however, is much more comprehensive than a transfer on death deed. A will can lay out your wishes as to how to distribute your money, investments, and belongings, as well as provide instructions for the care of any minor children or pets you leave behind. A TODD is much more limited in scope, as seen in the restrictions above.

A will is preferable to a transfer on death deed when you have multiple people to whom you would like to leave property. You may, for example, request in your will that your real estate be sold upon your death, and the proceeds split between multiple heirs. If you have some property that is eligible for a TODD and some that is not, the best solution is often to set up both a will and a TODD.

How Do I Create a Transfer on Death Deed?

The first step is to get your state-specific deed form. Even among states that allow TODDs, laws surrounding them will differ. After getting your form, you must choose a beneficiary. This can either be a person or an organization such as a charity. It may also be wise to name an alternate beneficiary in the event the one you originally chose passes away before you do. You will need to include an exact description of the property and sign the deed. The last step in the process is to file the deed with your local land records office, as it will not be valid until you do.

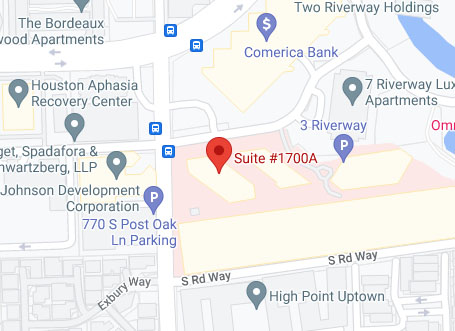

If you have any questions about transfer on death deeds, please call a knowledgeable Texas attorney now at 281-771-0560.