What Challenges Do Blended Families Face When Engaging in Estate Planning?

Modern family dynamics are complex and often involve blended families with children and grandchildren from previous marriages. Unfortunately, although many parents may not make distinctions between their stepchildren and biological children because they love them all equally, Texas law does not automatically make provisions for inheritance by stepchildren and their families. Additionally, if you do not create a will, the state’s intestacy laws will likely require your current spouse to share half of the estate’s community property with your children from a previous marriage. These outcomes may not be what you desire for your loved ones.

Failing to specifically address the inheritance of your current spouse and any stepchildren can lead to contentious family disputes and irreparable harm to relationships and finances. Careful estate planning is necessary to ensure your assets are distributed according to your wishes, and that all members of your blended family are protected. An experienced Texas estate planning lawyer can help you explore various tools to create a personalized strategy that meets your family’s unique needs.

What Estate Planning Methods and Tools May Be Useful For Blended Families?

Blended families often involve stepchildren, multiple marriages, and diverse financial backgrounds, making the estate planning process more intricate and requiring a more nuanced approach. Ensuring fair and equitable asset distribution while respecting family dynamics is crucial. Blended families may have varying priorities and goals, further complicating the estate planning process.

Under Texas’ intestate succession laws, stepchildren and step-grandchildren do not inherit through or from a stepparent or step-grandparent. Therefore, it is essential to make careful plans to include them as beneficiaries and protect their inheritance if that is your decision. Depending upon your needs, the following documents and financial tools can be leveraged to build a customized plan to safeguard the financial and emotional well-being of those most important to you.

Wills

A will is essential for specifying how your assets should be distributed upon death and is a fundamental estate planning document recommended for all individuals. It allows you to clearly outline your intentions, ensuring that your estate is divided according to your wishes and not subjected to intestate succession laws. Be advised that pre-printed will forms generally do not possess the detail necessary to handle complex blended family situations. Consulting with a lawyer is strongly recommended to ensure your documents meet state requirements and achieve the results you desire.

If you are considering a joint or mutual will with your spouse, you should discuss the implications of this choice with a knowledgeable estate planning attorney to ensure it will not have unintended consequences for other relatives. Additionally, if you have minor children, it is crucial that your will appoints a guardian to care for them in the event of one or both parents passing. This step is especially important in blended families where stepchildren may be involved, as the legal situation can become complicated without explicit instructions.

Trusts

While not a perfect solution for all situations, trusts can be a versatile tool that can be particularly beneficial for blended families. They can be structured to provide for the surviving spouse during their lifetime while ensuring that the remaining assets are preserved for children from previous relationships. Trusts can also protect assets from creditors and keep financial affairs private by avoiding probate court. There are several types of trusts available, each designed for specific purposes. An experienced trusts attorney can examine your situation and help you decide which trust types best suit your needs.

Deeds

In Texas, both the Transfer on Death Deed (TODD) and the Lady Bird Deed (also known as an Enhanced Life Estate Deed) are estate planning tools that allow property owners to transfer their real estate to a beneficiary upon their death without the need for the property to go through probate. While both serve a similar purpose, they have distinct characteristics and benefits. Execution of deeds with timely consultation can be a powerful cost and time saving approach to transferring assets when carefully implemented as part of an estate plan.

Life Insurance

Life insurance allows you to designate a beneficiary for your policy, which allows these funds to bypass the often lengthy probate process. Insurance proceeds can provide key immediate financial support to surviving family members, helping to cover living expenses, debts, and other obligations. As there are few limitations on who you can name as a beneficiary, life insurance policies can also be used to equalize inheritances among children from different relationships.

Prenuptial and Postnuptial Agreements

While frequently overlooked, prenuptial and postnuptial agreements can play an essential role in your estate plan. These agreements can be used to clarify each spouse’s financial rights and obligations, helping to protect the interests of children from previous relationships. Addressing these topics can help avoid conflicts and ensure your estate plan aligns with your family’s agreed-upon arrangements. Negotiating and drafting a premarital/prenuptial agreement also encourages open communication about financial goals, priorities, and estate planning wishes, which can set the stage for more transparent discussions throughout the marriage.

What Are the Best Practices for Approaching Estate Planning With a Complex Family Structure?

Being proactive and intentional in your estate planning ensures your stepchildren and others in your family are provided for according to your wishes. However, what happens before and after you create your estate planning documents can also be instrumental in their effectiveness. Consider the following actions as part of your overall approach to the process:

- Communicating clearly: Engaging in honest dialogue with all family members involved in the estate plan is vital. These discussions help manage expectations, address concerns, and minimize potential conflicts. By providing explanations, you ensure that everyone understands your intentions and the reasoning behind specific decisions.

- Regularly reviewing your estate plan: Blended families often experience changes, such as divorces, remarriages, or the birth of additional children. Periodically reviewing and updating the estate plan ensures it remains aligned with your family’s situation.

- Updating beneficiary designations: Frequently reviewing beneficiary designations on financial instruments, such as retirement accounts, whenever life events occur is critical. By keeping your designations current, you can ensure that these assets pass directly to your intended beneficiaries, bypassing the probate process.

What is the Value of Enlisting the Help of a Skilled Attorney

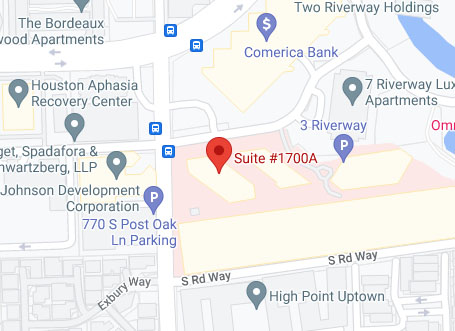

The structure of blended families can change dramatically over time as children grow up, new relationships are formed, or grandchildren are born. Regular discussions with family members and an estate planning attorney can ensure that the plan stays relevant and that documents are executed seamlessly. Our knowledgeable lawyers at The Hatchett Law Firm can provide guidance on the most effective strategies for your family’s circumstances and help you navigate the legal and financial intricacies of estate planning for your blended family, now and in the future. Contact our firm today at 281-771-0560 to schedule a free case evaluation and discover how we can assist you.